siteupstudio.ru

Prices

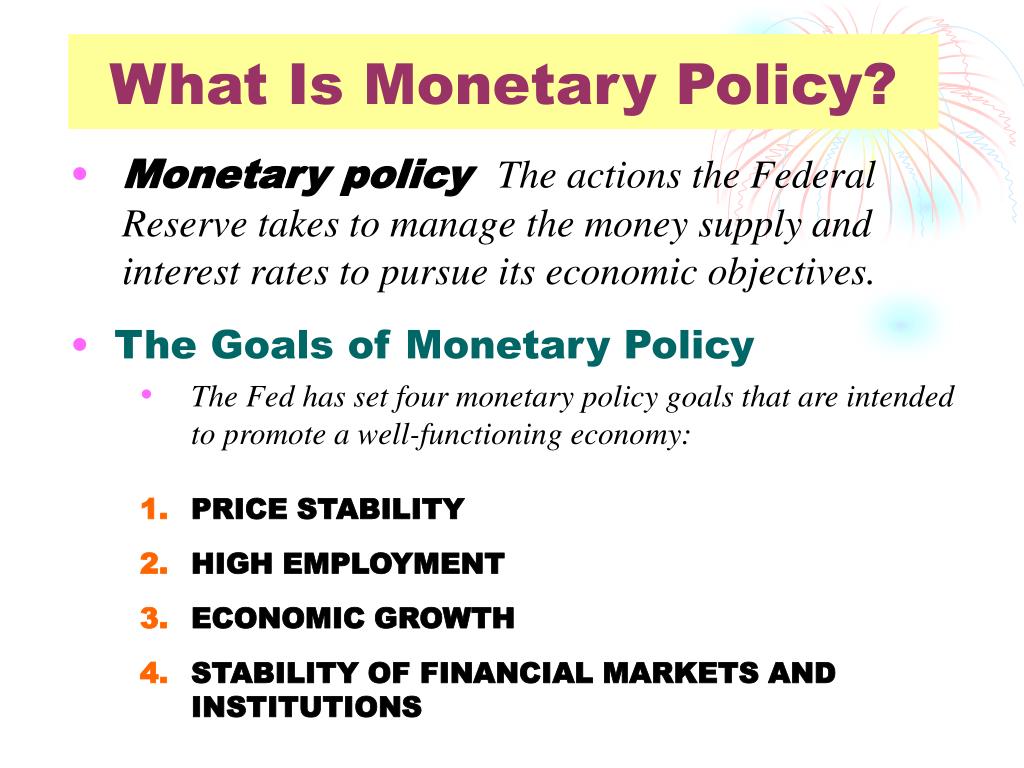

Define Monetary Policy

Monetary policy is the action a central bank or a government can take to influence how much money is in a country's economy and how much it costs to borrow. Central banks use monetary policy to manage interest rates and thus the availability of credit. Changes in credit conditions influence the levels of economic. Central banks use monetary policy to manage economic fluctuations and achieve price stability, which means that inflation is low and stable. Contractionary Monetary policy: A contractionary policy increases interest rates and limits the outstanding money supply to slow growth and decrease inflation. The Federal Open Market Committee (FOMC) conducts monetary policy by setting the target range for its policy rate -- the federal funds rate. What is monetary policy and how it works? Monetary policy is a policy set by the central bank. By using open market operations, changing the discount rate, or. The Fed sets the stance of monetary policy to influence short-term interest rates and overall financial conditions with the aim of moving the economy toward. What is monetary policy? Monetary policy is how central banks influence the economy by raising or lowering the money supply. · What are the tools of monetary. Monetary policy involves influencing interest rates to affect aggregate demand, employment and inflation in the economy. Monetary policy is the action a central bank or a government can take to influence how much money is in a country's economy and how much it costs to borrow. Central banks use monetary policy to manage interest rates and thus the availability of credit. Changes in credit conditions influence the levels of economic. Central banks use monetary policy to manage economic fluctuations and achieve price stability, which means that inflation is low and stable. Contractionary Monetary policy: A contractionary policy increases interest rates and limits the outstanding money supply to slow growth and decrease inflation. The Federal Open Market Committee (FOMC) conducts monetary policy by setting the target range for its policy rate -- the federal funds rate. What is monetary policy and how it works? Monetary policy is a policy set by the central bank. By using open market operations, changing the discount rate, or. The Fed sets the stance of monetary policy to influence short-term interest rates and overall financial conditions with the aim of moving the economy toward. What is monetary policy? Monetary policy is how central banks influence the economy by raising or lowering the money supply. · What are the tools of monetary. Monetary policy involves influencing interest rates to affect aggregate demand, employment and inflation in the economy.

The meaning of MONETARY POLICY is measures taken by the central bank and treasury to strengthen the economy and minimize cyclical fluctuations through the. Both monetary and fiscal policies are used to regulate economic activity over time. They can be used to accelerate growth when an economy starts to slow. The objective of monetary policy is to preserve the value of money by keeping inflation low, stable and predictable. The object of monetary policy is to influence the performance of the economy, as reflected in such factors as inflation, economic output, and employment. It. Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives. Monetary policy is the system used by central banks to manage and maintain a sustainable economy through influencing the supply and cost of money in the. Types of monetary policy. There are two main kinds of monetary policy: contractionary and expansionary. Monetary policies can either increase or decrease the. Monetary policy is the macroeconomic policy laid down by the central bank. It involves management of money supply and interest rate. Monetary policy is used to influence changes in the prices of the goods and services we consume. The ECB's primary objective is to maintain price stability in. Federal Reserve Chair Janet Yellen goes before the Senate Banking Committee to give a semi-annual monetary policy testimony. Monetary policy has lived under many guises. But however it may appear, it generally boils down to adjusting the supply of money in the economy to achieve some. What is Monetary Policy? Monetary policy is an economic policy that manages the size and growth rate of the money supply in an economy. It is a powerful tool. Monetary policy refers to one of the principal means through which government authorities in a market economy influence the overall economic activity. Federal Reserve Chair Janet Yellen goes before the Senate Banking Committee to give a semi-annual monetary policy testimony. MONETARY POLICY definition: actions taken by a government to control the amount of money in an economy and how easily available. Learn more. Monetary policy is the macroeconomic device by which the monetary authorities of a country seek to positively influence the performance of economic. Monetary policies are demand-side macroeconomic policies. They work by stimulating or discouraging spending on goods and services. Monetary policy is a crucial tool employed by central banks, such as the Federal Reserve, to manage a country's money supply, interest rates, and overall. Expansionary monetary policy is where central banks are looking to increase the money supply in the economy to stimulate growth and keep inflation at the target. Types of monetary policy. There are two main kinds of monetary policy: contractionary and expansionary. Monetary policies can either increase or decrease the.

2 3 4 5 6